— Second Avenue to Use Proprietary Investment Platform to Manage Additional 500 SFR Homes and Deploy Capital for the real estate business of Sculptor Capital Management —

TAMPA, Fla., June 19, 2023 /PRNewswire/ — Second Avenue (“Second Avenue”), a full-service, institutional quality single-family rental platform (“SFR”), today announced a strategic joint venture (the “JV”) and property management agreement with Sculptor Real Estate (“Sculptor”), the real estate business of Sculptor Capital Management, Inc. (NYSE: SCU), a leading global alternative asset management firm specializing in real estate, credit, and multi-strategy investment products.

Sculptor will contribute approximately 500 SFR homes to the JV and commit up to $100 million of additional capital to grow the JV’s SFR portfolio. Sculptor’s existing SFR portfolio covers eight of the eighteen major markets where Second Avenue currently owns SFR homes.

“Sculptor is the fifth multi-billion dollar fund since early 2022 to partner with Second Avenue to acquire homes, and they join an esteemed group of legacy investors including Monroe Capital, Waterton, BLG Capital Advisors and others,” said Second Avenue CEO and Founder Mike Rothman. “Today’s news further demonstrates investor demand for our platform which is purpose-built for the SFR industry – and clearly signals how much growth potential still remains for investors in the broader SFR space.”

“The Sculptor joint venture will enable Second Avenue to expand into an additional five markets by strategically deploying capital over the coming years,” Rothman added.

Sculptor’s real estate business invests in both opportunistic real estate private equity and real estate credit. Since 2003, Sculptor has raised approximately $8.1 billion of committed real estate capital and has completed 195 transactions across 28 diverse real estate asset classes, including within the SFR segment.

“Second Avenue has an experienced, uniquely qualified team and a tremendous SFR platform with an end-to-end proprietary technology that effectively manages both maintenance and capital decisions,” said Steven Orbuch, Founder and President of Sculptor Real Estate. “Second Avenue not only understands how these tech-enabled systems can help generate superior returns for investors, but also they know how to add value to SFR homes. We are excited to partner with Second Avenue on this new venture.”

Despite facing headwinds from COVID-19, inflation, and an exponential rise in interest rates, Second Avenue has consistently delivered superior risk-adjusted returns to its investors, because of its capability in multi-acquisitional channels, since starting SFR management in 2019. As a result, Second Avenue has had a compound annual growth rate of acquiring homes of an impressive 139 percent since 2019.

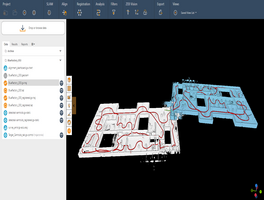

The Second Avenue team now totals 175 employees, which includes senior executive leadership deep in SFR experience, and an additional 70 dedicated technology experts focused on technology development for the platform which is unparalleled to any other SFR platform of its size. Second Avenue has its national headquarters in Tampa, along with operational offices across the markets.

JLL Capital Markets represented Second Avenue in this transaction.

About Second Avenue

Second Avenue provides high quality professionally managed rental homes for today’s families. A full-service single-family rental platform, founded in 2017, Second Avenue offers proprietary, technology based solutions to home buyers, sellers, renters, and investors. The firm’s unified, end-to-end institutional quality asset management platform aggregates and enhances all aspects of single family rental investment and operations. With over $1 billion under management, Second Avenue is privately held and headquartered in Tampa with regional teams throughout the United States.

For more information about Second Avenue, visit: www.secondavenue.com

About Sculptor

Sculptor is a leading global alternative asset management firm with approximately $35 billion in assets under management specializing in real estate, credit, and multi-strategy investment products. Sculptor’s real estate business was founded in 2003 and has invested in over $20.3 billion of real estate assets across 28 different real estate related asset classes including direct equity investments, preferred equity structures, ground leases, senior loan, mezzanine loans, among other real estate investments. For more information, visit www.sculptor.com.

SOURCE Second Avenue