DALLAS, March 30, 2023 /PRNewswire/ — Crossplane Capital (“Crossplane”), a Dallas-based private equity firm, announced today that it has partnered with Jeff Owen and Ben Peterson by making an equity investment in Kaemark (“Kaemark” or the “Company”). Headquartered in Giddings, Texas since its founding in 1972, Kaemark is a leading turnkey designer and manufacturer of millwork, seating and equipment for the salon, salon suites, spa, medical and veterinary markets throughout North America.

“Under Jeff and Ben’s leadership for the last 22 years, Kaemark has evolved into a strategic partner for its beauty industry customers,” said Brian Hegi, Managing Partner of Crossplane Capital. “We are excited to support the meaningful growth Kaemark’s customers are experiencing, including growing the Company’s turnkey solution in the spa, medical and veterinary markets.”

“When Ben and I started the process to find a partner to support Kaemark’s growth, we sought to find a group that shared our collaborative culture and also had manufacturing expertise,” said Jeff Owen, CEO of Kaemark. “In Crossplane Capital, we found the ideal partner who embraces our culture and brings a unique operational playbook that will help us continue to scale with our customers.”

“Kaemark has a significant growth opportunity in front of it, given the attractive end markets it serves and the demand for its integrated solution,” said Mike Sullivan, Partner of Crossplane Capital. “Crossplane is excited to support initiatives that will increase the Company’s design, production and installation capacity and efficiency in order to be an even more value-added partner to its customers.”

About Crossplane Capital

Launched in 2018, Crossplane Capital is a private equity firm based in Dallas investing control equity in industrial business services, niche manufacturing and value-added distribution businesses. The firm focuses on family and founder-owned businesses seeking an operationally oriented partner and complex transactions involving strategically unique, lower middle market businesses. Targeted situations include family and founder-owned businesses, corporate carve-outs, restructurings, and other special situations.

The Crossplane Capital team has decades of collective experience transforming industrial companies as senior executives, operational improvement consultants, strategy consultants, restructuring advisors and private equity investors. For more information, please visit www.crossplanecapital.com.

About Kaemark

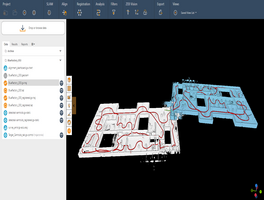

Kaemark is a leading, turnkey supplier of millwork, seating and equipment into the beauty, spa, medical and veterinary markets with its design, manufacturing and installation turnkey solution. For more information, please visit https://kaemark.com/.

SOURCE Crossplane Capital